[ad_1]

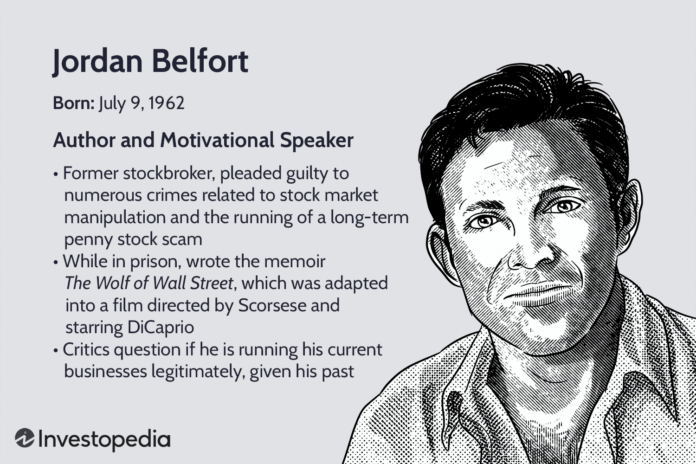

Jordan Belfort embodied Wall Street’s reputation for greed and ruthlessness. In 1999, Belfort pleaded guilty to multiple crimes related to stock market manipulation and a long-term scam involving penny stocks.

He leveraged his Wall Street experiences to become a prominent speaker and author. Belfort penned two memoirs, “The Wolf of Wall Street,” which inspired a major Hollywood film, and “Way of the Wolf.”

Key Takeaways

- Jordan Belfort is a former Wall Street trader and founded Stratton Oakmont, Inc.

- Belfort pleaded guilty to fraud and was sentenced to four years in prison, but served 22 months before his release.

- Belfort wrote two memoirs: “The Wolf of Wall Street ” and “Way of the Wolf.”

Investopedia / Joshua Seong

Education and Career

Born in 1962, Jordan Belfort grew up in Queens, N.Y. According to his memoir “The Wolf of Wall Street,” Belfort worked with a friend to sell Italian water ice desserts from inexpensive styrofoam coolers at a beach near his childhood home, earning $20,000 in the summer between high school and college.

Belfort studied biology at American University and planned to enroll in dental school. However, when the dean of the University of Maryland School of Dentistry warned students on the first day that dentistry was not a path to financial success, Belfort dropped out.

Belfort worked as a salesperson in Long Island and grew the business with a team, selling more than two tons of meat and seafood per week. At age 25, Belfort filed for bankruptcy when the venture failed. He launched his career as a stockbroker and at age 30, founded Stratton Oakmont Inc., an over-the-counter brokerage. Stratton Oakmont was linked to the IPOs of nearly three dozen companies, including the IPO for the footwear company Steve Madden.

Fast Fact

Footwear executive Steve Madden spent time in prison following his dealings with Belfort’s Stratton Oakmont. From 1991 through 1997, Madden participated in stock manipulations led by Stratton Oakmont and Monroe Parker Securities, Inc.

Convicted of Fraud

Illegal dealings as the leader of Stratton Oakmont ultimately sent Jordan Belfort to prison. Stratton Oakmont participated in pump-and-dump schemes to artificially inflate the price of penny stocks. The firm was considered a boiler room, with a team that pressured investors to invest in highly speculative securities.

Throughout Stratton Oakmont’s history, the National Association of Securities Dealers (NASD) pursued consistent legal actions against the firm. In 1996, the firm shuttered.

In 1999, Belfort and his associate Danny Porush were indicted for money laundering and securities fraud. Belfort pleaded guilty to fraud, which may have cost his investors as much as $200 million. He was sentenced to four years and ordered to pay over $110 million in restitution. Ultimately, he served 22 months.

Life After Prison

Following his release from prison in 2006, Belfort was required to pay 50% of his income to his defrauded former investors through 2009. Federal prosecutors filed a complaint in 2013 alleging that Belfort hadn’t paid the appropriate amount. Belfort reached a separate deal with federal authorities to complete the restitution payments. Reports suggest he repaid only about 10% of the restitution he owed.

Belfort faced criticism for profiting from his story of defrauding innocent people, while many of his victims were not fully compensated. Belfort reinvented himself as a motivational speaker. One of his primary topics was the distinction between greed, ambition, and passion on Wall Street. He runs corporate training focused on building effective sales teams.

Is “The Wolf of Wall Street” a True Story?

The movie is based on Jordan Belfort’s memoir. It details his time as a Wall Street stockbroker and his conviction for financial fraud.

Has Jordan Belfort Committed Crimes Since His Time in Prison?

Belfort has been the subject of fraud investigations since his release in 2006. In 2014, media outlets uncovered ties between Belfort and an Australian employee training company for a suspected scam involving government funding. However, no charges were filed.

What Is Securities Fraud?

According to the SEC, “securities fraud” includes crimes like the unregistered offer or sale of securities, Ponzi schemes, misappropriation of funds, and insider trading.

The Bottom Line

Jordan Belfort is a former Wall Street trader guilty of crimes related to stock market manipulation and fraud, serving 22 months of a four-year prison sentence. Belfort wrote two memoirs, one adapted for the movie “The Wolf of Wall Street.” Belfort reinvented himself as a motivational speaker and a corporate sales trainer.

[ad_2]

Source link

:max_bytes(150000):strip_icc():format(jpeg)/who-is-jordan-belfort-v2-c0e58b029d7b4734a1bcf759dc7d22ee.png)