[ad_1]

The information on this page was current at the time it was published. Regulations, trends, statistics, and other information are constantly changing. While we strive to update our Knowledge Base, we strongly suggest you use these pages as a general guide and be sure to verify any regulations, statistics, guidelines, or other information that are important to your efforts.

Taxation in the United Kingdom

When doing business in the United Kingdom, you need to consider whether your activities will trigger tax obligations even if you are not a United Kingdom-based business and have no physical presence in the United Kingdom. There are several ways in which you could trigger tax obligations by doing business in the UK or with UK residents.

Because business tax in the UK is far too complicated and company-specific, this tax information will only pertain to the other indirect taxes you might be responsible for when doing business in the UK. In general, if your business is based in the UK or the executive board is based in the UK, you will be liable for taxes on globally generated income. On the other hand, if neither your business nor the board is based in the UK, you will be liable for only tax on income generated in the UK, i.e., from sales ( VAT) in the UK, a permanent establishment or representative, dividends, or licenses.

How Value-Added Tax (VAT) Works in the UK

There is no separate sales tax in the United Kingdom. Instead, a Value Added Tax (VAT) system applies to most goods and services sold in the country. (VAT) is a broad-based consumption tax levied on the sale of all supplies of goods and services in the United Kingdom. VAT is paid every time a customer buys a taxable good or service from a VAT-registered business. Suppliers essentially act as VAT collection agents. VAT applies to you if you are a VAT-registered business that supplies goods or services to customers.

You must register for VAT with HM Revenue and Customs (HMRC) if your business’ VAT taxable turnover is more than £85,000.

How do I comply with VAT?

VAT-registered businesses must charge VAT on their goods and services. All VAT-registered businesses must report the amount of VAT they charged and the amount of VAT they paid to HM Revenue and Customs (HMRC). This is done through a VAT Return, which is usually submitted every 3 months. VAT-registered businesses may reclaim the VAT they have paid on business-related goods and services.

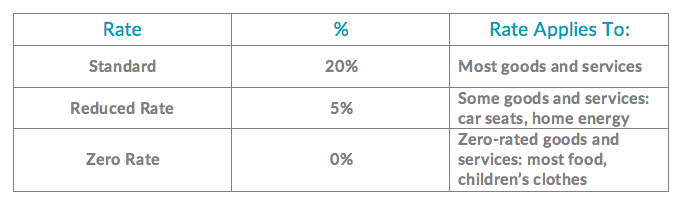

There are three VAT rates and it is your responsibility to ensure you charge the correct rate.

- Standard Rate: Most goods and services are standard rate. Unless a good or service is classified as reduced rate or zero rate, you should charge the standard rate.

- Reduced Rate: Reduced rate depends on the good or service being provided and the circumstances of the sale.

- Zero Rate: Zero rate means the goods or services are still VAT taxable, but the rate you charge your customers is 0%. All zero-rate transactions must still be accounted for and reported on your tax return.

You will find detailed information on the registration process here. Online registration is done through HMRC. Here is a list of reduced-rate or zero-rated goods and services.

VAT Rates For Goods and Services in the UK

If a transaction is standard, Reduced, or Zero-rated, you must:

- Charge the correct rate of VAT;

- Calculate the VAT if a single price is shown that either includes or excludes VAT;

- Show the VAT information on your invoice;

- Record the transaction in your VAT account (a summary of your VAT); and

- Show the amount on your VAT Return.

You cannot charge VAT on items that are exempt or “out of the scope” of VAT. As a VAT-registered business, you can sell goods or services to charities at the zero or reduced rate. It is your responsibility to check and confirm that the charity is eligible and apply the correct rate. You may be charged VAT on discounts and deals. You do not have to pay VAT on free samples, if they meet certain criteria.

VAT on Digital Services in the UK

As of January 1, 2015, the VAT rules for place of supply change in the European Union (EU) for sales of digital services from businesses to consumers.If your business sells digital services to consumers in EU member states, you must charge VAT at the rate due in the consumer’s country.

What is considered a digital service to which VAT applies? To which digital service providers does VAT apply?Digital services for purposes of determining VAT include, but are not limited to:

- Broadcasting

- Telecommunications

- E-services, such as video on-demand, downloadable applications (apps), music downloads, gaming, e-books, software or software updates, downloadable trainings, tutorials, images, etc.

VAT on digital services applies to the sale of those digital services to consumers, it does not apply if you sell only to other businesses.

Keeping Your VAT Records in the UK

All VAT-registered businesses must:

- Keep records of sales and purchases;

- Keep a separate summary of VAT called a VAT account; and

- Issue correct VAT invoices.

You must keep VAT records for at least six years (10 years if you use the VAT MOSS Service). You can keep VAT records on paper, electronically, or as part of a software program, e.g., a book-keeping system. All records must be accurate, complete, and readable.HMRC can visit your business to inspect your records keeping and can charge you a penalty if your records are not in order.

For specific requirements of VAT invoicing and record retention, see the Information Commissioner’s Office’s website.

How Business Property Tax Works in the UK

Most UK businesses face annual business property taxes levied by their local council. This applies to most non-domestic premises, but exemptions exist for some sectors like charities or farms. The responsibility for keeping your location updated rests with you as specific requirements might vary.

Tax rates depend on your property’s valuation, which can fluctuate over time.

Other Indirect Tax Obligations for UK Businesses

Beyond VAT, there might be other indirect taxes applicable to your business depending on its nature and activities. Here’s a breakdown of some of the most common indirect taxes in the UK:

- UK Insurance Premium Tax: Applies to most insurance premiums paid in the UK, with a standard rate of 12% (as of April 2023). This tax is usually added to the insurance premium you pay.

- UK Alcohol and Tobacco Duty: Taxes are levied on the sale of alcohol and tobacco products. The rates of duty vary depending on the product type, alcohol content, and tobacco content. These taxes are typically included in the price you pay for these goods.

- UK Air Passenger Duty: A tax levied on passengers departing from UK airports on most commercial flights. The rate of APD depends on the class of travel and the destination. This tax is usually included in the price of your airline ticket.

- UK Aggregates Levy : A tax on the commercial exploitation of rock, sand, and gravel. This tax is typically relevant to businesses in the construction or extractive industries.

- UK Landfill Tax: A tax on the disposal of waste to landfill sites. This tax incentivizes businesses to reduce waste and explore alternative waste disposal methods.

- UK Soft Drinks Industry Levy: A tax on the production or importation of sugary soft drinks in the UK. This tax is intended to promote public health by discouraging the consumption of sugary drinks.

- UK Climate Change Levy and Carbon Price Floor: These are taxes levied on businesses that use energy from fossil fuels. The CCL is a tax on deliveries of electricity, gas, coal, and other fuels. The CPF is a price floor set on carbon emissions. These taxes are designed to encourage businesses to reduce their reliance on fossil fuels and transition to cleaner energy sources.

References

[ad_2]

Source link