[ad_1]

What Is Return on Investment (ROI)?

Return on investment (ROI) is a ratio that measures the profitability of an investment by comparing the gain or loss to its cost. It helps assess the potential return of investments on stocks or business ventures. ROI is usually presented as a percentage and can be calculated using a specific formula.

Key Takeaways

- Return on investment (ROI) is an approximate measure of an investment’s profitability.

- It’s calculated by subtracting the initial cost of an investment from its final value and then dividing the resulting number by the cost of the investment multiplying it by 100.

- ROI can be used to measure the profitability of stock shares, to decide whether to purchase a business or to evaluate the success of a real estate transaction.

- One disadvantage of ROI is that it doesn’t account for how long an investment is held.

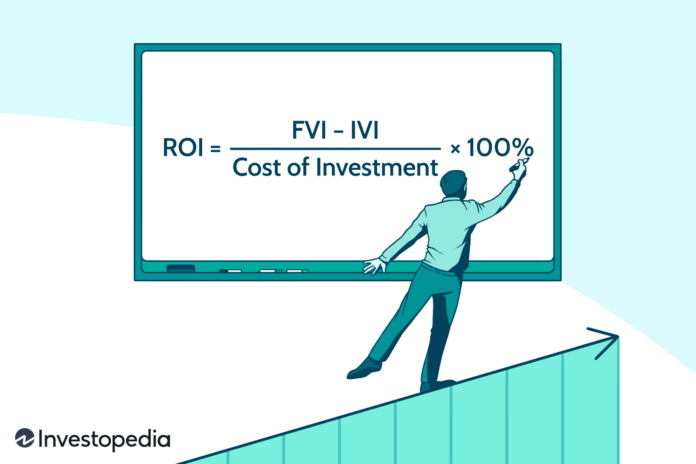

How to Calculate ROI

ROI can be calculated using either of two methods.

First method:

ROI= Cost of InvestmentNet Return on Investment×100%

Second method:

ROI=Cost of InvestmentFVI−IVI×100%where:FVI=Final value of investmentIVI=Initial value of investment

Investopedia / Mira Norian

How to Understand ROI

ROI is typically expressed as a percentage because it’s easier to understand than a ratio. The ROI calculation includes the net return in the numerator because returns from an investment can be either positive or negative.

Total returns and total costs should be considered to calculate ROI with the highest degree of accuracy. Annualized ROI should be considered for a comparison between competing investments,

Important

It means that net returns are in the black when ROI calculations yield a positive figure because total returns exceed total costs. It means that the net return is in the red when ROI calculations yield a negative figure because total costs exceed total returns.

The ROI formula can be deceptively simple. It depends on an accurate accounting of costs. That’s easy in the case of stock shares but it’s more complicated when calculating the ROI of a business project that’s under consideration.

ROI Example

Assume an investor bought 1,000 shares of the hypothetical company Worldwide Wickets Co. at $10 per share. The investor sold the shares for $12.50 one year later. They earned dividends of $500 over the one-year holding period. The investor spent a total of $125 on trading commissions to buy and sell the shares.

The ROI for this investor can be calculated as follows:

ROI=$10×1000($12.50−$10)×1000+$500−$125×100=28.75%

Total returns and total costs must be considered to calculate net returns. Total returns for a stock result from capital gains and dividends. Total costs include the initial purchase price and any trading commissions paid.

The gross capital gain from this trade is ($12.50 – $10.00) x 1,000 before commissions. The $500 amount refers to the dividends received by holding the stock and the $125 is the total commissions paid. Capital gains contributed 23.75% and 5% came from dividends. This distinction is important because capital gains and dividends are taxed at different rates.

ROI=Capital Gains%−Commission%+Dividend Yield

Capital Gains=($2500÷$10,000)×100=25.00%Commissions=($125÷$10,000)×100=1.25%Dividend Yield=($500÷$10,000)×100=5.00%ROI=25.00%−1.25%+5.00%=28.75%

Annualized ROI

The annualized ROI calculation provides a solution for one of the key limitations of the basic ROI calculation: it doesn’t take into account the length of time that an investment is held, referred to as the holding period. The formula for calculating annualized ROI is as follows:

Annualized ROI=[(1+ROI)1/n−1]×100%where:n=Number of years investment is held

Assume an investment that generated an ROI of 50% over five years. The simple annual average ROI of 10% was obtained by dividing ROI by the holding period of five years. It’s only a rough approximation of annualized ROI because it ignores the effects of compounding that can make a significant difference over time.

The longer the period, the bigger the difference between the approximate annual average ROI and annualized ROI. The annual average ROI is calculated by dividing the ROI by the holding period in this scenario.

Annualized ROI=[(1+0.50)1/5−1]×100=8.45%

This calculation can also be used for holding periods of less than a year by converting the holding period to a fraction of a year. Assume an investment that generated an ROI of 10% over six months.

Annualized ROI=[(1+0.10)1/0.5−1]×100=21%

The numeral 0.5 years is equivalent to six months.

An Alternative ROI Calculation

If, for example, commissions were split, there is an alternative method of calculating this hypothetical investor’s ROI for the Worldwide Wickets Co. investment. Assume the following split in the total commissions: $50 when buying the shares and $75 when selling the shares.

IVI=$10,000+$50=$10,050FVI=$12,500+$500−$75FVI=$12,925ROI=$10,050$12,925−$10,050×100ROI=28.75%where:IVI=Initial value (cost) of investmentFVI=Final value of investment

Fast Fact

Annualized ROI helps account for a key omission in standard ROI: how long an investment was held.

Comparing Investments and Annualized ROI

Annualized ROI is especially useful when comparing returns between investments or evaluating different investments.

Assume that an investment in stock X generated an ROI of 50% over five years. An investment in stock Y returned 30% over three years. You can determine what the better investment was in terms of ROI by using this equation:

AROIx=[(1+0.50)1/5−1]×100=8.45%AROIy=[(1+0.30)1/3−1]×100=9.14%where:AROIx=Annualized ROI for stock XAROIy=Annualized ROI for stock Y

Stock Y had a superior ROI compared to stock X.

Combining Leverage With ROI

Leverage can magnify ROI if the investment generates gains but it can amplify losses if it’s a losing investment.

Assume that an investor bought 1,000 shares of Worldwide Wickets Co. at $10 per share. The investor bought these shares on a 50% margin. They invested $5,000 of their capital and borrowed $5,000 from their brokerage firm as a margin loan.

This investor sold the shares for $12.50 one year later. The shares had earned dividends of $500 over the holding period. The investor also spent a total of $125 on trading commissions when buying and selling the shares.

The calculation must also account for the cost of buying on margin. The margin loan carried an interest rate of 9%.

The interest on the margin loan ($450) should be considered in total costs. The initial investment is now $5,000 because of the leverage employed by taking the margin loan.

ROI=($10×1000)−($10×500)($12.50−$10)×1000+$500−$125−$450×100=48.5%

ROI is still substantially higher at 48.50% compared with 28.75% if no leverage was employed even though the net dollar return was reduced by $450 due to the margin interest,

Now consider if the share price fell to $8.00 instead of rising to $12.50. The investor decides to take the loss and sell the full position. Here’s the calculation for ROI in this scenario:

ROI=($10×1000)−($10×500)[($8−$10)×1000]+$500−$125−$450×100=−$5,000$2,075=−41.5%

The ROI of -41.50% is much worse than an ROI of -16.25% which would have occurred if no leverage had been employed.

The Problem of Unequal Cash Flows

You may be contending with unequal cash flows when evaluating a business proposal. ROI may fluctuate from one year to the next in this scenario. This type of ROI calculation is more complicated because it involves using the internal rate of return (IRR) function in a spreadsheet or calculator.

Assume you’re evaluating a business proposal that involves an initial investment of $100,000. This figure is shown under the “Year 0” column in the Cash Outflow row in the table. The investment will generate cash flows over the next five years. This is shown in the Cash Inflow row. The row called Net Cash Flow sums up the cash outflow and cash inflow for each year.

Investopedia / Sabrina Jiang

Using the IRR function, the calculated ROI is 8.64% using the IRR function.

The final column shows the total cash flows over the five years. Net cash flow over this period is $25,000 on an initial investment of $100,000. The cash flow table would then look like this if the $25,000 was spread out equally over five years.

Investopedia / Sabrina Jiang

The IRR is now only 5.00%.

The substantial difference in the IRR between these two scenarios has to do with the timing of the cash inflows. Substantially larger cash inflows are received in the first four years in the first case. These larger inflows in the earlier years have a positive impact on IRR given the time value of money.

Advantages of ROI

The biggest benefit of ROI is that it is a relatively uncomplicated metric. It is easy to calculate and intuitively easy to understand.

Due to its simplicity, ROI has become a standard, universal measure of profitability. As a measurement, it is not likely to be misunderstood or misinterpreted because it has the same connotations in every context.

Disadvantages of ROI

Disadvantages to the ROI measurement include that it doesn’t take into account the holding period of an investment. This can be an issue when comparing investment alternatives.

Assume investment X generates an ROI of 25%. Investment Y produces an ROI of 15%. We can’t assume that X is the superior investment unless the time frame of each investment is also known. It’s possible that the 25% ROI from investment X was generated over five years and the 15% ROI from investment Y was generated in only one year.

Calculating annualized ROI can overcome this hurdle when comparing investment choices.

No Risk Adjustment

Another disadvantage of ROI is that it doesn’t adjust for risk.

Investment returns have a direct correlation with risk: the higher the potential returns, the greater the possible risk. This can be observed in the stock market where small-cap stocks are likely to have higher returns than large-cap stocks but are also likely to have significantly greater risks.

An investor who’s targeting a portfolio return of 12% would have to assume a substantially higher degree of risk than an investor whose goal is a return of 4%. The eventual outcome may be very different from the expected result if that investor hones in on the ROI number without also evaluating the associated risk.

Some Costs May Be Omitted

ROI figures can be inflated if all possible costs aren’t included in the calculation. This can happen deliberately or inadvertently.

All associated expenses should be considered in evaluating the ROI on a piece of real estate. These include mortgage interest, property taxes, insurance, and maintenance costs that can be unpredictable.

These expenses can be subtracted from the expected ROI. The ROI figure may be grossly overstated without including all of them in the calculation.

Some Issues May Be Ignored

ROI considers only financial gains when evaluating the returns on an investment. It doesn’t consider ancillary benefits such as social or environmental costs.

An ROI metric known as social return on investment (SROI) helps to quantify some of these benefits for investors.

What Is ROI?

Return on investment, or ROI, is a straightforward measurement of the bottom line. How much profit (or loss) did an investment make after considering its costs? It’s used for a wide range of business and investing decisions. It can calculate the actual returns on an investment, project the potential return on a new investment, or compare the potential returns on investment alternatives.

How Is Return on Investment (ROI) Used?

ROI can be used to measure profit or loss on a current investment or evaluate the potential profit or loss of an investment you’re considering making. ROI omits a key factor, however: the length of time it took to earn that profit or take that loss. A stock that makes a 10% return in one year is preferable to a stock that makes a 10% return in four years.

How Do I Calculate ROI for Real Estate?

The return on investment (ROI) formula remains the same whether you’re evaluating the performance of a single stock or considering the potential profit of a real estate investment.

Some investments are more complicated to evaluate than others, however, particularly when it comes to costs. An ROI on a real estate investment must include all the potential costs that may be involved including maintenance, repairs, insurance, and lost rental income.

The Bottom Line

Return on investment (ROI) is a simple and intuitive metric of the profitability of an investment. There are some limitations to this metric, however. It doesn’t consider the holding period of an investment and it’s not adjusted for risk. ROI is nonetheless a key metric used by business analysts to evaluate and rank investment alternatives.

[ad_2]

Source link

:max_bytes(150000):strip_icc():format(jpeg)/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)