[ad_1]

D-Wave Quantum (QBTS) on Thursday reported a wider-than-expected fourth quarter loss while revenue edged by views. First quarter guidance for D-Wave came in well above expectations as investors mull the outlook for quantum computing stocks amid growing competition.

In the December quarter, D-Wave reported an 8-cent loss on an adjusted basis versus a 6-cent loss a year earlier. Revenue rose 21% to $2.3 million.

Analysts had forecast a 6-cent loss on revenue of $2.2 million.

Q4 bookings rose 502% to $18.3 million, the company said.

For the March quarter, D-Wave said it expects revenue of $10 million, topping estimates of $2.55 million.

↑

X

How To Buy Stocks: IBD’s Four Pillars Of Investing

Further, D-Wave in February won a big deal in Germany. The Jülich Supercomputing Centre bought one of D-Wave’s quantum systems.

On the stock market today, D-Wave stock popped 18.7% to close at 6.91.

Among other quantum computing stocks, shares in IonQ (IONQ) dipped 2% to 21.37. Rigetti Computing (RGTI) fell 2.2% to 8.75.

Also, D-Wave’s Qubits 2025 quantum computing user conference will take place in Scottsdale, Ariz. starting March 31. The conference will feature presentations from D-Wave executives, customers, and industry thought leaders.

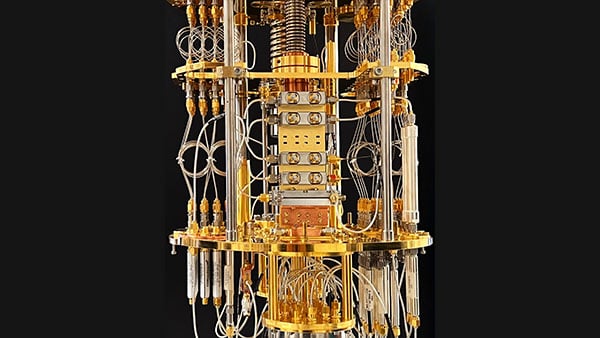

Quantum computing works on a subatomic level and uses exotic technologies, like supercold superconductor chips. Further, Quantum computing’s ultimate benefit is that it aims to solve problems too complex for today’s classical computers.

Further, D-Wave on Wednesday claimed a major advance in the technology, sending quantum computing stocks up.

Follow Reinhardt Krause on Twitter @reinhardtk_tech for updates on artificial intelligence, cybersecurity and cloud computing.

YOU MAY ALSO LIKE:

Learn The Best Trading Stock Rules From IBD’s Investor’s Corner

Want To Trade Options? Try Out These Strategies

Monitor IBD’s “Breaking Out Today” List For Companies Hitting New Buy Points

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

[ad_2]

Source link