[ad_1]

When you need a personal loan, you have a number of options to turn to. Banks and credit unions are two common sources, as are the growing numbers of online lenders. Another option in many cases is borrowing from family members or close friends. While sometimes easier to get, these loans can also be fraught with peril—for both borrowers and lenders. If you’re considering making (or asking for) a loan involving a friend or family member, here is what you need to know to make your decision.

Key Takeaways

- When someone needs to borrow money, a family member or close friend may be their best (or only) option.

- If you are asked to lend money to someone you know, don’t take the decision lightly.

- There can be good reasons to make a loan, as well as good reasons to say no.

- If you do decide to lend, plan to get the terms in writing to help prevent any misunderstandings.

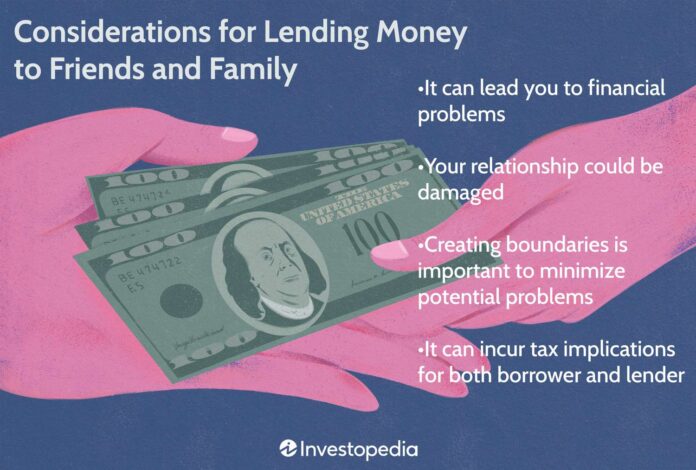

Investopedia / Jake Shi

Friend and Family Loans: When Do They Make Sense?

Roughly 20% of U.S. adults get financial support from friends or family, and up to one-third of U.S. adults provide support to others, according to the Consumer Financial Protection Bureau (CFPB). But while loans are a relatively common way of doing that, they aren’t always the best way to go.

Friend and family loans can make sense in certain situations if handled properly. Those situations can include a situation in which the friend or family member wouldn’t qualify for a bank or other regular loan. For example, a young person who is just starting out in their career might not have enough of a credit history to qualify for a loan on their own.

Another option in this situation, besides lending money, may be to co-sign their loan application. But that comes with its own set of dangers. In particular, the co-signer will be responsible for the loan if the other person can’t repay, and they could also see their credit score damaged.

Another example may be if the borrower needs money in a hurry, such as for an urgent car repair, and can’t wait for a bank or other lender to make its decision.

Two other key factors to consider in deciding if a friend or family loan makes sense is whether the potential lender has the money to spare and whether the would-be borrower has shown themselves to be a responsible person who is likely to pay it back. Both of those questions are covered in more detail below.

The Do’s for Lending to Friends and Family

Lend Money Only to People You Trust

If some distant cousin you barely know comes to you asking for a loan, you’ll want to think a lot harder about it than if the would-be borrower is your sibling, child, or parent.

But no matter how close the relative, if you know that person to be irresponsible with money or to have another serious problem, such as one involving substance abuse, you may still want to think twice. If you do decide to lend money in that situation, be prepared to never see it again.

Limit Loans to What You Can Afford

No matter how much you want to help, consider your own financial situation first. Do you have the cash available, and can you afford to part with it, knowing there’s a chance that you’ll never get it back? You generally want to avoid depleting your own emergency fund to help with someone else’s emergency.

Get It in Writing

To avoid misunderstandings and ill-feelings, most experts suggest getting the terms of friend or family loans in writing.

You can find templates for this purpose on many websites. Search under “loan agreement.”

At the very least, you’ll want your agreement to specify the amount you’re lending and when you expect to be repaid. That might take the form of a single payment at a certain date or a series of payments over a series of dates. Be as specific as possible, and make sure the borrower knows what’s expected of them and what happens if they fail to live up to the agreement. If you’re planning to charge interest, be sure that is clear, too.

Tip

If a significant amount of money is involved, you might want to involve a lawyer.

The Don’ts for Lending to Friends and Family

Don’t Lend More Than You Can Afford

If you can’t afford to lend to someone, avoid going into debt or using your emergency fund to meet their requests. You want to prioritize your own financial situation.

Don’t Let Guilt Drive Your Decision

Try to make a decision based on reasoning and not emotion. For example, don’t let the other person play on your guilt to persuade you to lend more than you can.

Don’t Lend Someone Your Credit

Avoid using your credit to provide a loan to someone. You might consider co-signing a loan application in some limited instances. But if you do, you’ll be stuck paying off the loan yourself if the other person can’t or won’t. In addition, you could wreck your own credit in the process, making it difficult for you to get a personal loan, car loan, home mortgage, or other form of credit in the future.

The Bottom Line

Lending money to family members or close friends can sometimes make sense, especially if the person is responsible and has no other options. Even then, don’t put your own finances in jeopardy. If you decide to proceed, make sure to get the terms in writing and consider what would happen if the person fails to repay.

Often these loans go off without a hitch. Other times they can lead to bitter resentment. So before you agree to a loan, think it through and perhaps consult with a financial advisor for specific guidance on your situation.

[ad_2]

Source link

:max_bytes(150000):strip_icc():format(jpeg)/do-s-and-don-ts-of-lending-to-friends-and-family-5088469-final-a63ae6345ee54d1487b76c2ae1a71603.jpg)