[ad_1]

CDs and annuities can both be good ways to save for the future

Reviewed by Katie Miller

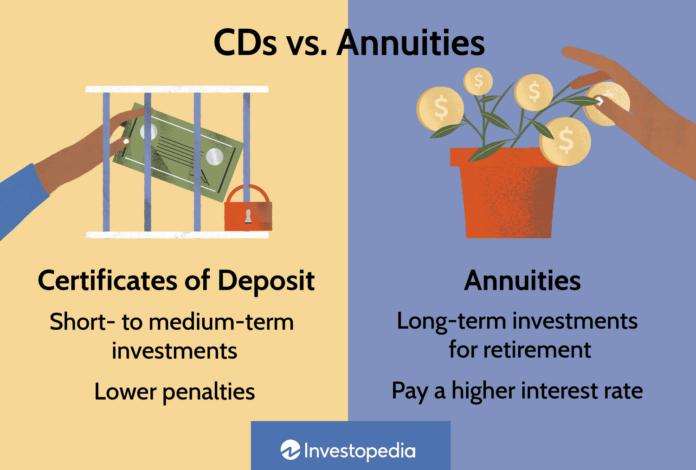

CDs vs. Annuities: An Overview

Both CDs and annuities are ways to save for the future. Most people will use an annuity to save for retirement. In contrast, CDs are best used for short- to medium-term savings goals. Some annuities can be a good option if you want to put aside some extra money for retirement. If you want a guaranteed return within five years, look for one of the best CDs paying the highest APY.

Key Takeaways

- CDs and annuities both offer a set return on your money and are insured or guaranteed by the FDIC or insurers.

- In exchange for a lump-sum deposit, CDs offer shorter terms and lower penalties for withdrawing money in an emergency.

- An annuity involves either a lump sum deposit or a series of payments called premiums.

- Annuities provide future payments and potentially higher interest but may come with many fees.

- A CD is best for short- to medium-term savings, and an annuity is usually a long-term retirement investment.

Investopedia / Michela Buttignol

Looking for a top CD rate? Every business day, we rank the highest available APYs in our roundup of the best nationwide CDs.

Certificates of Deposit

Risk

CD investments are protected by the same insurance that covers all deposit products. The Federal Deposit Insurance Corporation (FDIC) provides insurance for bank customers, and the National Credit Union Administration (NCUA) provides insurance for credit union customers.

When you open a CD with an FDIC- or NCUA-insured institution, up to $250,000 (per account, per account category) of your funds on deposit with that institution are protected if that institution fails.

Additionally, if you pass away, your CD's beneficiary or beneficiaries receive your CD.

Ease and Transparency

Various banks, credit unions, and online brokers offer various CDs you can shop for online. You can easily compare the best bank CD rates using APY, and compare terms, account minimums, and early withdrawal penalties. Banks and credit typically lay out any requirements and restrictions regarding the CD on their websites.

Opening a CD is a fairly straightforward process that involves a simple application and transfer of funds. Closing a CD is equally straightforward.

Liquidity

CDs are not among the most liquid of investments, but they are more liquid than annuities. You must lock your funds into an account for a set period, such as one month, three months, or five years. If you need to access these funds in an emergency, you must pay a small early withdrawal penalty, typically a few months' interest.

Interest rates

Returns from CD interest rates are generally lower than annuity rates but higher than savings accounts. This makes them an excellent way to preserve your capital, especially if their rates keep up or exceed the inflation rate.

Because inflation chips away at value, it's important to ensure your CDs have a rate that will make them at least keep up with inflation—which savings account rates generally don't do.

Taxes

The interest you earn through a CD is taxed as ordinary income and should be reported as income on your annual tax filing. However, if you open an IRA CD, you can benefit from tax-advantaged savings.

Important

Ensure you understand the early withdrawal penalties for your annuity or CD account. You may pay fees if you need to access your money in an emergency. These fees are generally higher for an annuity because annuities are designed to be held for longer than a CD.

Annuities

Risk

The issuing insurance company guarantees annuities. You could lose your guarantee if the insurance company goes out of business. While state-based guaranty associations add some protection, there's a chance only part of your claim may be paid due to limitations.

Other risks shared with CDs include interest-rate risk if interest rates go up, and inflation risk, where your investment can't keep up with inflation's impact on costs. Unlike CDs, annuities may also feature a death risk — some annuities don't continue annuity payments if you die.

Ease and Transparency

Buying an annuity isn't as straightforward as opening a CD account, as an annuity is a contract with an insurance company. Like other insurance products, annuities can be complicated and come in various options more suitable for some individuals than others.

You may be unable to easily compare insurers, rates, and minimums using online marketplaces like a CD. So you must typically consult with a salesperson specializing in annuities by phone or in person.

Annuities also feature administrative fees, mortality and risk charges, and other fees that may be hard to understand.

Liquidity

Annuities typically make periodic, ongoing payments to individuals, unlike CDs, where your investment is received as a lump sum at the end of the term.

But because annuities are generally designed to be held longer than CDs (until retirement, rather than just a few years), annuities usually have a surrender period, during which you cannot withdraw funds without paying a surrender charge or fee. There are also tax implications for withdrawals from retirement annuities before age 59½.

Because of this, investors who are considering purchasing an annuity should carefully consider any personal financial requirements.

Interest rates

Though annuities are less flexible than CDs, this disadvantage is offset by an advantage—annuities generally pay a higher interest rate than CDs. This is because the financial institution where you hold your annuity is exposed to less risk because you will keep it longer.

Most CDs feature fixed interest rates. Annuities may have fixed rates, but variable annuities feature variable interest rates.

Taxes

Annuities are designed for retirement and come with tax advantages when used in this way. The interest your annuity earns is tax-deferred, so you pay taxes only when you begin withdrawing from it. Withdrawals are taxed at the same tax rate as your ordinary income.

If you fund an annuity through an individual retirement account (IRA) or another tax-advantaged retirement plan, you may also be entitled to a tax deduction for your contribution. This is known as a qualified annuity.

Special Considerations

There are many types of annuities, but they are mainly used for retirement purposes to help address the risk of outliving lifetime savings. An annuity's appeal is a dependable income stream over time, which makes it suitable for people looking to secure a steady income stream in retirement.

CDs come with different maturities and pay you a lump sum when they mature. So, CDs are more suited to those looking to save money for a short-term goal. However, using a CD ladder approach, you can use CDs to design income streams. Rather than rolling them into another CD, you can use the proceeds as income as they mature and payout.

Frequently Asked Questions (FAQs)

Is an Annuity Better Than a CD?

It depends. If you want to save in the short term, a CD can offer more flexibility than an annuity. Some annuities could possibly be a better choice if you want to ensure a steady income stream in retirement.

Are CDs and Annuities Safe?

Yes. The FDIC or NCUA insures CDs for up to $250,000 if the financial institution fails. The issuing insurance company insures annuities. In most cases, state guaranty associations also add protection, but only part of any claim might be paid. It’s essential to choose a financial institution you trust, but your money should be safe in either type of investment.

What Are Early Withdrawal Penalties?

Both CDs and annuities have fees and penalties if you withdraw your money early. You have to leave your money in the CD for the term you’ve agreed to, or you’ll probably have to pay sizable early withdrawal penalties that could wipe out your returns. Similarly, annuities have a surrender period, during which withdrawals will incur a deferred sales fee. This period generally spans several years.

The Bottom Line

Both CDs and annuities offer a set return on your money and are guaranteed or insured. However, CDs can be more transparent, easy to find and open, and flexible than annuities.

CDs have shorter terms and lower penalties if you need to withdraw money in an emergency. A CD is best for short—to medium-term investments and an annuity can be better for long-term retirement investments.

[ad_2]

Source link