[ad_1]

It’s hard to imagine looking at a losing trade as a good thing. After all, people don’t invest in the stock market to lose money. But the information a loss gives you is worth the payment. We had a large gain in Spotify followed by two small losses. By keeping those losses small, not only did we protect ourselves from larger drawdowns in Spotify, but also the general market.

↑

X

Best Offense Starts With A Good Defense

Spotify Stock Buys Couldn’t Hold

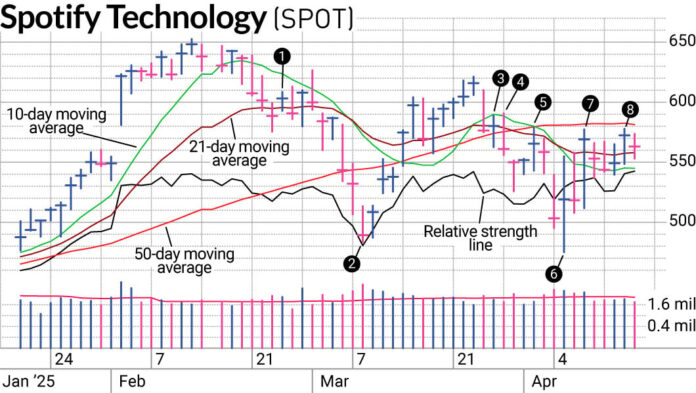

Our exposure on IBD’s SwingTrader dropped dramatically starting Feb. 19. And while it stayed light, it hasn’t been at zero. When Spotify Technologies (SPOT) bounced at its 21-day moving average line it joined SwingTrader (1) but was quickly removed as its rally fizzled.

The benefit of having an exit strategy is unmistakable. Spotify stock fell 20% over the next two weeks (2) compared to our loss of less than 1%. If you weren’t willing to cut the loss quickly, it easily could have turned into a bigger hole.

Looking For A Calm In The Storm? Have A Trading Game Plan For All Markets.

Meanwhile, the stock market was having problems of its own. During that time the Nasdaq composite saw nearly a 10% drop. This is where positions act as feedback. If few positions are working, you have little reason to carry heavy exposure.

Another Buy Fails

At one point, we were looking at the possibility of a “V-shaped” recovery in the stock market. After a strong move from the bottom, Spotify stock saw a pullback to its 21- and 50-day moving average lines where it bounced (3). We gave it another try but quickly saw a rejection of support the next day (4). Here again, the feedback was loud and clear. Our position attempts weren’t getting traction. Despite some weak rally attempts that quickly hit resistance (5), Spotify saw another 18% loss from our exit (6). Not only was the market damage done to Spotify and positions we exited, it also hit the Nasdaq with more than a 15% plunge and enter bear market territory.

As discussed in a previous column, our low exposure during this downturn gave us a huge edge in outperformance. If you don’t take as large a drawdown during the bad times, you are in a much better position when the good times return.

Preparing For The Good Times

Our thesis is that the good times will come again. So it’s best to be ready. How to prepare? Keep an eye on stocks that are holding up better than other stocks or the indexes. Though still below the 50-day moving average line, Spotify is still showing relative strength compared to the overall market and is above its 21-day line and 200-day lines where the indexes are still below theirs. After a few tests of the 50-day line at the beginning of April (5), Spotify has been skirting the line for the past week and a half (7 & 8). While the indexes are struggling under their 21-day lines, if Spotify can break above its 50-day line in the coming days, that might set it up for another try.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on X, formerly known as Twitter, at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Read The Big Picture To Stay On The Right Side Of The Market

Sector Rotation Provides Useful Clues For Market Health

[ad_2]

Source link