[ad_1]

Cutting-edge semiconductor equipment maker ASML (ASML) on Wednesday beat analyst estimates for the first quarter but its Q2 sales guidance was short of views. ASML stock fell in early trading.

The Netherlands-based company earned the equivalent of $6.80 a share on sales of $8.77 billion in the March quarter. Analysts polled by FactSet had expected ASML to earn $6.16 a share on sales of $8.32 billion. In the year-earlier period, ASML earned $3.31 a share on sales of $5.63 billion, FactSet said. ASML reports financial results in euros.

↑

X

Tariff Update: Trump Exempts These Tech Goods From 125% Hike As China Trade War Rages On

For the second quarter, ASML predicted sales of 7.45 billion euros ($8.47 billion), based on the midpoint of its guidance. Analysts were modeling 8.36 billion euros ($9.5 billion).

In premarket trading on the stock market today, ASML stock dropped more than 4% to 652.34.

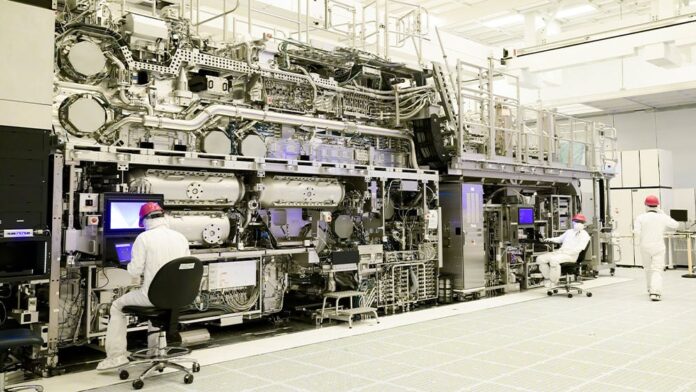

The Dutch company makes advanced lithography equipment for etching tiny circuits onto semiconductors. It is the world’s only manufacturer of extreme ultraviolet (EUV) lithography equipment.

ASML Chief Executive Christophe Fouquet said the company’s Q1 sales were in line with its guidance. But its gross profit margin of 54% was above target, driven by a favorable EUV product mix.

“In the first quarter, we shipped our fifth High NA (numerical aperture) system, and we now have these systems at three customers,” Fouquet said in a news release. He noted that artificial intelligence continues to be the primary growth driver in the industry.

“Our conversations so far with customers support our expectation that 2025 and 2026 will be growth years,” he said. “However, the recent tariff announcements have increased uncertainty in the macro environment and the situation will remain dynamic for a while.”

TD Cowen analyst Krish Sankar maintained his buy rating on ASML stock after the report.

“The direct and indirect effects of global tariffs are still being assessed by ASML and at this time the 2025 outlook remains unchanged,” Sankar said in a client note. “The company also expects 2026 to still be a growth year.”

ASML stock ranks fifth out of 27 stocks in IBD’s semiconductor equipment industry group, according to IBD Stock Checkup. It has an IBD Composite Rating of 64 out of 99.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Nvidia To Take $5.5 Billion Charge Over New China Chip Curbs

Macroeconomic Uncertainty Pressuring Microsoft, Software Stocks

How To Know It’s Time To Sell Your Favorite Stock

[ad_2]

Source link