[ad_1]

Though it can be difficult to invest in a stock when its price is falling, there are certain individuals who have a knack for doing so. In this article, we’ve outlined five investors who demonstrated remarkable timing by making big investments during the 2007-2009 financial crisis, eventually generating big gains as a result.

Key Takeaways

- The 2007–09 financial crisis saw markets fall, erasing trillions of dollars of wealth around the world.

- Savvy investors recognized a unique buying opportunity, with many companies’ shares for sale at deep discounts.

- Once markets recovered from the Great Recession, these investors realized tremendous gains from their assertive maneuvers.

The Crisis

You can’t really understand the philosophies and actions of successful investors without first getting a handle on the financial crisis. What happened in the lead-up to the crash and the Great Recession that followed afterward remains stamped in the memories of many investors and companies.

The financial crisis of 2007–09 was the worst to hit the world since the stock market crash of 1929. In 2007, the subprime mortgage market in the United States collapsed, sending shock waves throughout the market. The effects were felt around the globe, and even caused the failure of several major banks, including Lehman Brothers.

Panic ensued, with people believing they would lose more if they didn’t sell their securities. Many investors saw their portfolio values drop by as much as 30%. The sales resulted in rock-bottom prices.

Important

During the crisis, while many people were selling, there were others who saw this as a chance to increase their positions in the market at a big discount.

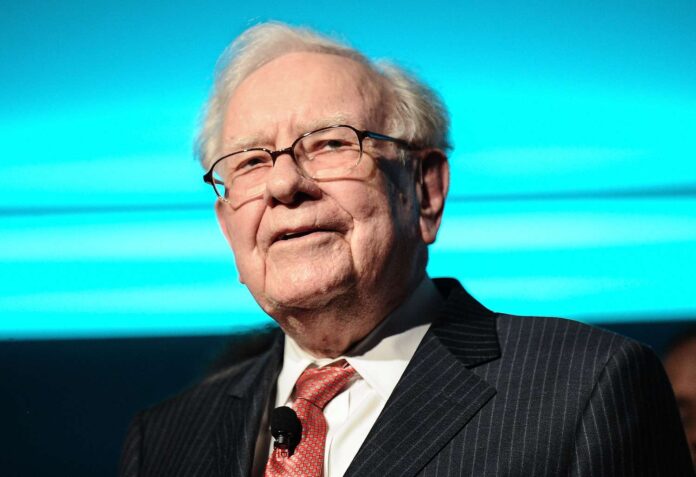

1. Warren Buffett

Shutterstock

In October 2008, Warren Buffett published an article in the op-ed section of The New York Times, declaring he was buying American stocks during the equity downfall brought on by the credit crisis. As he once said, investors should “be fearful when others are greedy, and be greedy when others are fearful.”

His buys included the purchase of $5 billion in perpetual preferred shares in Goldman Sachs (GS) that paid him a 10% interest rate and included warrants to buy additional Goldman shares. Goldman also had the option to repurchase the securities at a 10% premium. This agreement was struck between Buffett and the bank in 2008. The bank ended up buying back the shares in 2011.

Buffett did the same with General Electric (GE), buying $3 billion in perpetual preferred stock with a 10% interest rate and redeemable in three years at a 10% premium. He also purchased billions in convertible preferred shares in Swiss Re and Dow Chemical (DOW), all of which required liquidity to get them through the tumultuous crisis. As a result, Buffett not only made billions for himself, but also helped steer these and other American firms through an extremely difficult period.

2. John Paulson

Adobe Stock

Hedge fund manager John Paulson reached fame during the crisis for a spectacular bet against the U.S. housing market. This timely bet made his firm, Paulson & Co., an estimated $20 billion during the crisis.

Paulson quickly switched gears in 2009 to bet on a subsequent recovery and established a multibillion-dollar position in Bank of America (BAC) as well as approximately two million shares in Goldman Sachs. He also bet big on gold at the time and invested heavily in Citigroup (C), JP Morgan Chase (JPM), and a handful of other financial institutions.

Paulson’s 2009 overall hedge fund returns were decent. He also posted huge gains in the big banks he invested in. The fame he earned during the crisis also helped bring in billions in additional assets and lucrative investment management fees.

3. Jamie Dimon

Thinkstock

Jamie Dimon used fear to his advantage during the crisis, making huge gains for JP Morgan. At the height of the financial crisis, Dimon used the strength of his bank’s balance sheet to acquire Bear Stearns and Washington Mutual, which were two financial institutions brought to ruins by huge bets on U.S. housing.

JP Morgan acquired Bear Stearns for $10 a share, or roughly 15% of its value, in March 2008. In September of that year, it also acquired Washington Mutual. The purchase price was also for a fraction of Washington Mutual’s value earlier in the year. From its lows in March 2009, shares of JP Morgan more than tripled over the next 10 years and made shareholders and its CEO quite wealthy.

4. Ben Bernanke

The Associated Press

As the former head of the Federal Reserve (Fed), Ben Bernanke was at the helm of what turned out to be a vital period for the U.S. central bank. The Fed’s actions were ostensibly taken to protect both the U.S. and global financial systems from meltdown, but brave action in the face of uncertainty worked out well for the Fed and underlying taxpayers.

A 2011 article detailed that profits at the Fed came in at $82 billion in 2010. This included roughly $3.5 billion from buying the assets of Bear Stearns and AIG, $45 billion in returns on $1 trillion in mortgage-backed security (MBS) purchases, and $26 billion from holding government debt. The Fed’s balance sheet tripled from an estimated $800 billion in 2007 to absorb a depression in the financial system, but appears to have worked out nicely in terms of profits now that conditions have returned to normal.

5. Carl Icahn

Thinkstock

Carl Icahn is another legendary fund investor with a stellar track record of investing in distressed securities and assets during downturns.

His expertise is in buying companies and gambling firms in particular. In the past, he acquired three Las Vegas gaming properties during financial hardships and sold them at a hefty profit when industry conditions improved. Icahn sold the three properties in 2007 for approximately $1.3 billion—many times his original investment. He began negotiations again during the crisis and was able to secure the bankrupt Fontainebleau property in Las Vegas, Nevada, for approximately $155 million, or about 4% of the estimated cost to build the property. Icahn ended up selling the unfinished property for nearly $600 million in 2017 to two investment firms, making nearly four times his original investment.

What Was the 2007–09 Global Financial Crisis?

The global financial crisis began with cheap credit and lax lending standards that fueled a housing bubble. When the bubble burst, banks were left holding trillions of dollars of worthless investments in subprime mortgages. The Great Recession that followed cost many their jobs, their savings, and their homes.

Who Is Warren Buffett?

Warren Buffett is a legendary value investor in Nebraska who turned an ailing textile mill into a financial engine that powered what would become the world’s most successful holding company, Berkshire Hathaway. Known as the “Oracle of Omaha” for his investment prowess, Buffett has amassed a personal fortune in excess of $162 billion, according to Forbes.

What Is the U.S. Federal Reserve System?

The Federal Reserve System is the central bank of the United States. Often called the Fed, it is arguably the most influential financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system.

The Bottom Line

One key differentiating factor for these investors is their ability to stay calm during a crisis. They are examples of how to take advantage of the market when it is in a panic. When more normalized conditions return, savvy investors can be left with sizable gains, and those who are able to repeat their earlier successes in subsequent downturns can end up quite wealthy.

[ad_2]

Source link

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-849890542-8f378e57387a4d2d92feab754fd17dc7.jpg)